Accelerate hiring key talent to deliver care and exceed patient satisfaction.

Attract skilled candidates, speed up hiring and grow expertise in your workforce.

Simplify recruiting finance and banking talent with a platform for hard-to-fill roles.

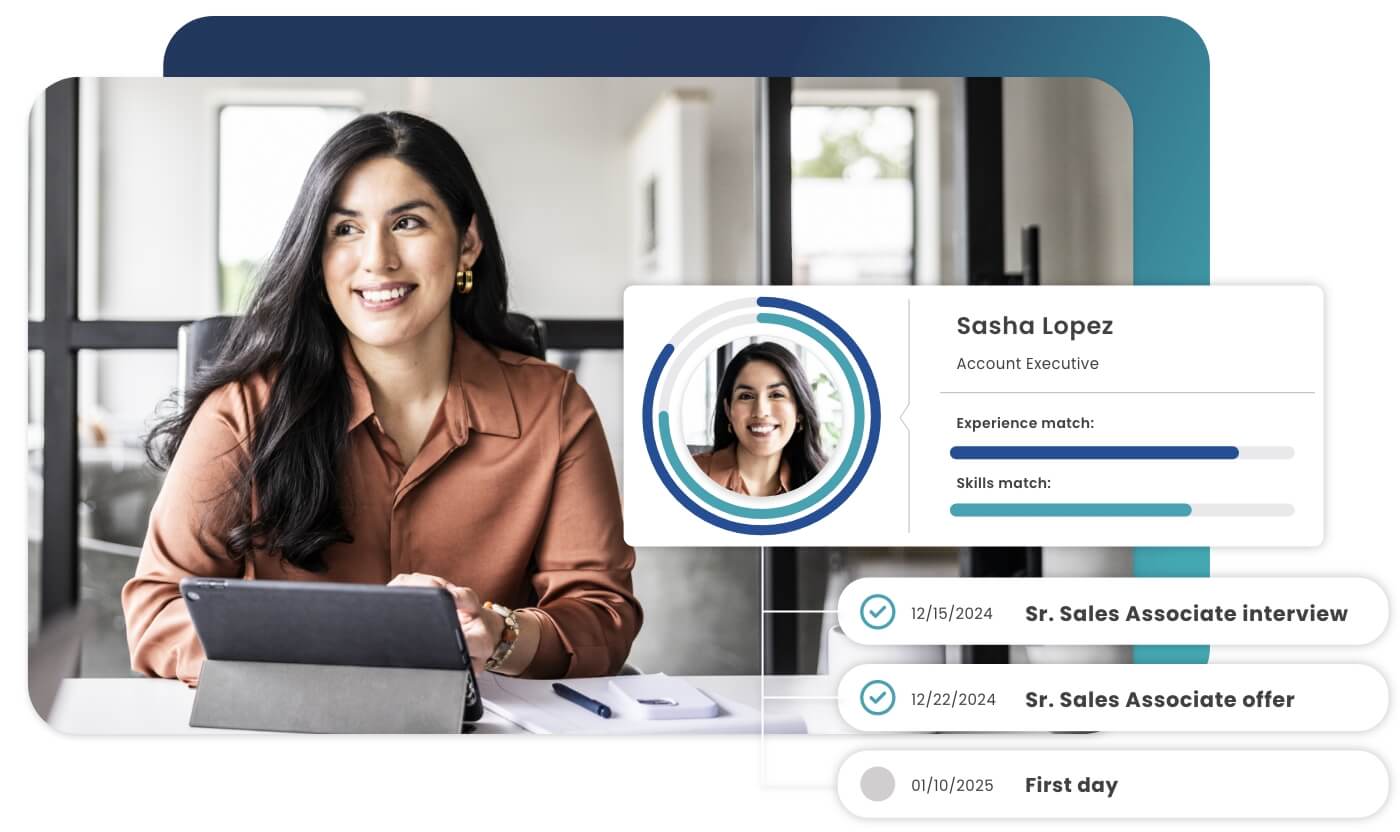

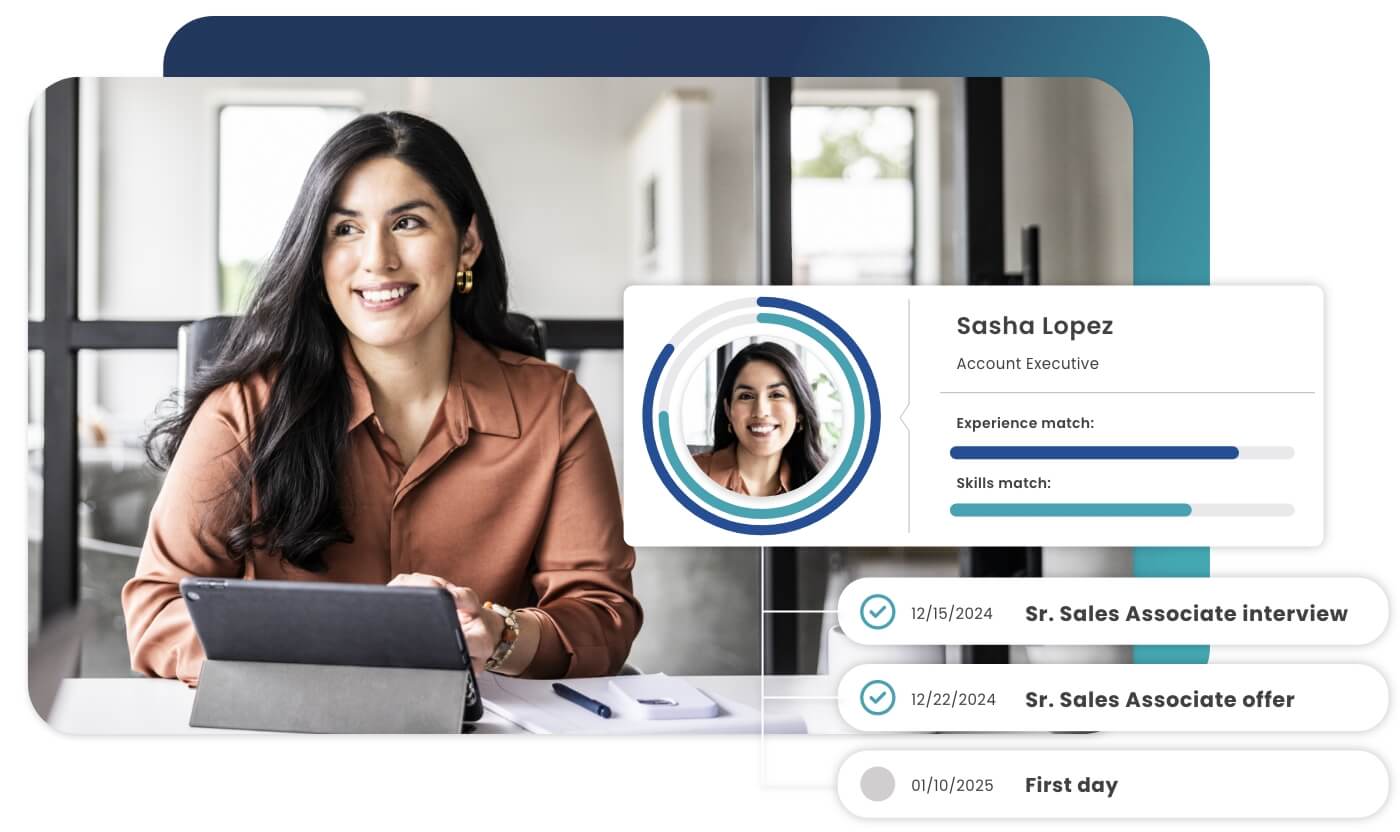

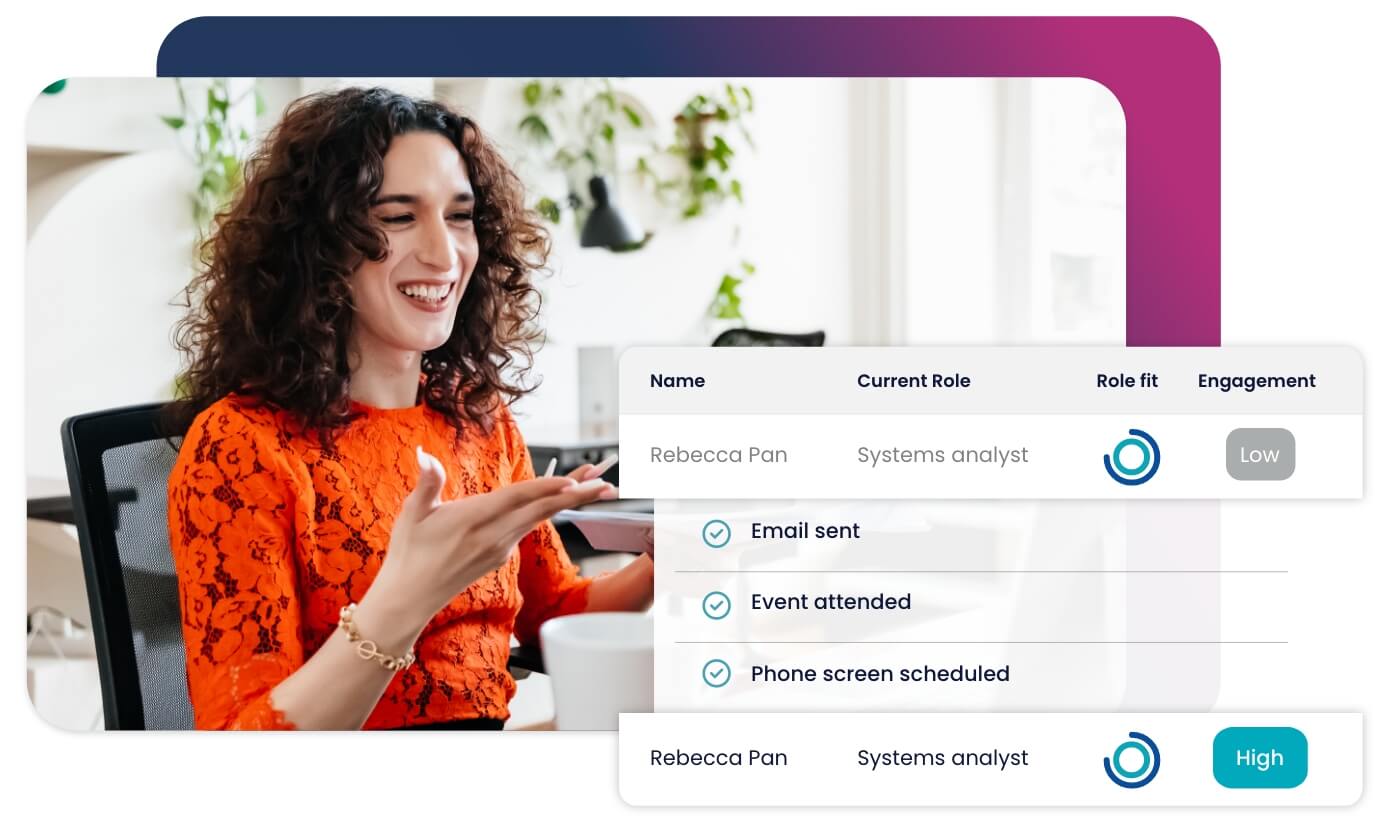

Build a talent pipeline that engages and drives your business forward.

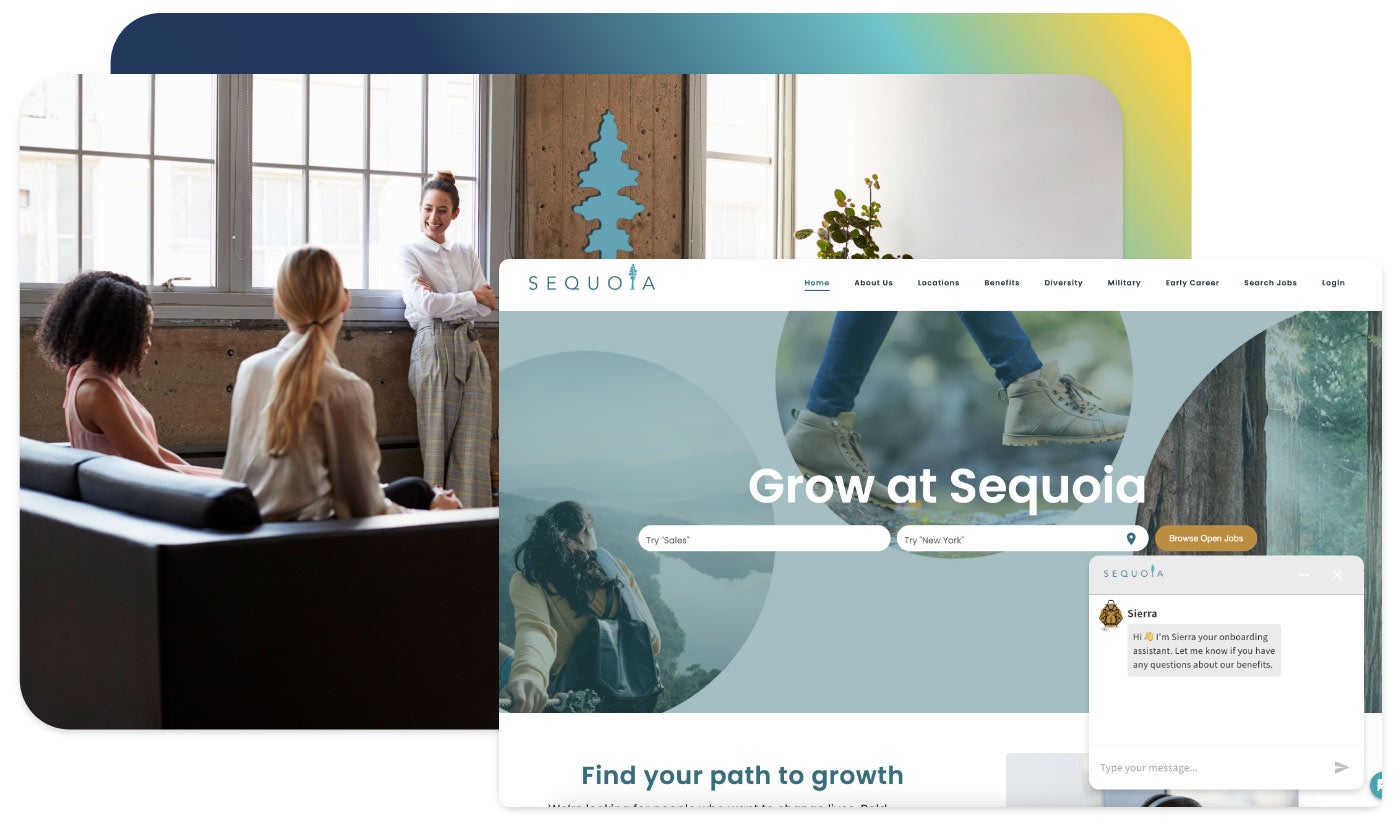

See how diverse and global enterprises use iCIMS to employ millions, drive innovation and connect communities worldwide.

Learn how a beloved restaurant hires 40,000+ annually with a great candidate experience.

Uncover unique market insights, explore best practices and gain access to talent experts across our library of content.

View press releases, media coverage, the latest hiring data and see what analysts are saying about iCIMS.

Streamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and iCIMS.

The combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Our award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Our partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

The May employment report was less notable for the size of any particular upside surprise than the consistency of its upside surprises and the good news throughout. The rise in employment across the establishment and household surveys was on roughly the same scale, wage growth ticked back up, and the 3-month average in payroll growth returned to about 180k – comfortably within its range since late 2016. Intriguingly, the progress on several areas of labor market slack suggested that the U.S. labor market is not at full employment after all.

The Highlights:

The Rundown:

The Outlook: