Accelerate hiring key talent to deliver care and exceed patient satisfaction.

Attract skilled candidates, speed up hiring and grow expertise in your workforce.

Simplify recruiting finance and banking talent with a platform for hard-to-fill roles.

Build a talent pipeline that engages and drives your business forward.

See how diverse and global enterprises use iCIMS to employ millions, drive innovation and connect communities worldwide.

Uncover unique market insights, explore best practices and gain access to talent experts across our library of content.

View press releases, media coverage, the latest hiring data and see what analysts are saying about iCIMS.

Streamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and iCIMS.

The combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Our award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Our partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

The seasons may be changing, but the job market is finally holding steady. 2023 saw many twists and turns in employer and applicant activity. But their behavior in March was relatively even keeled. Our April Workforce report examines this trend and:

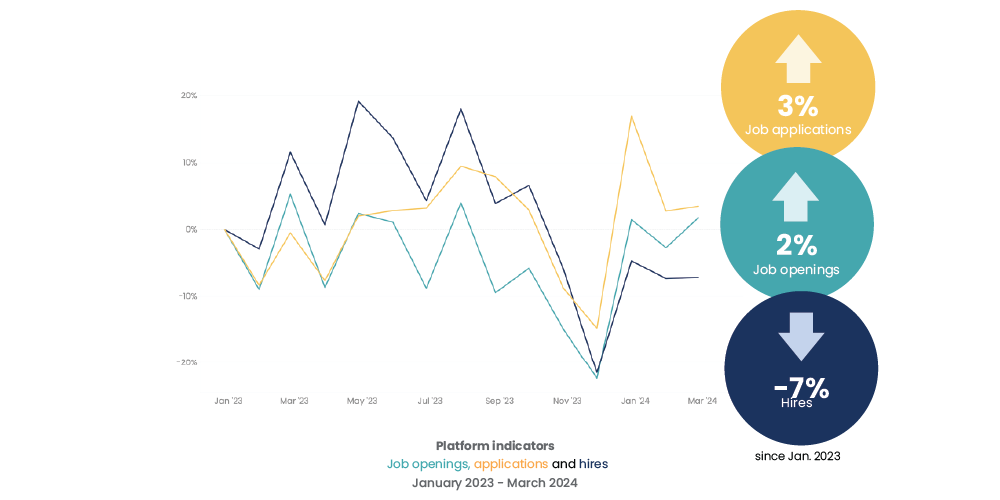

The 2023 job market was like a rollercoaster. Job applications, job openings and hires skyrocketed and plummeted throughout the year.

If last year’s market was the stuff of theme parks and carnivals, this year’s is a peaceful river cruise. In March, job applications and job openings quietly climbed from January 2023 levels by 3% and 2%, respectively. There was slightly more drama where hiring was concerned. Hires fell 7%, but even that change appears mild when compared to the sharp plunges hiring saw last year.

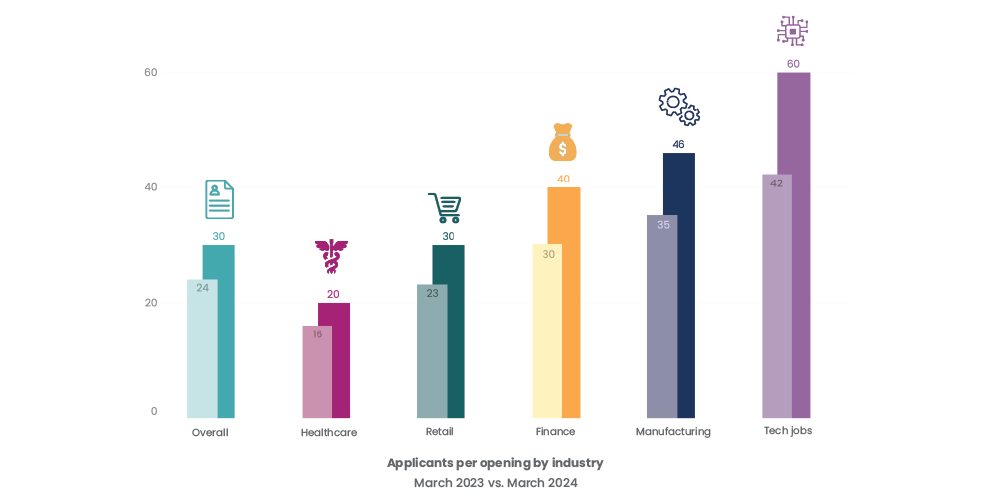

Applicants per opening grew steadily between March of 2023 and March 2024. This upward trend is likely leaving recruiters busy fielding more and more applications. An influx of applicants may mean more work, but it also means recruiters have more choices. To capitalize on this trend, recruiters need to focus on finding the best candidates, and fast.

Certain industries are seeing bigger growth in applicants per opening (APO). Tech-related jobs, for instance, have seen a 45% increase in APO since March 2023. Manufacturing jobs also saw a solid 31% growth in APO during the same time period.

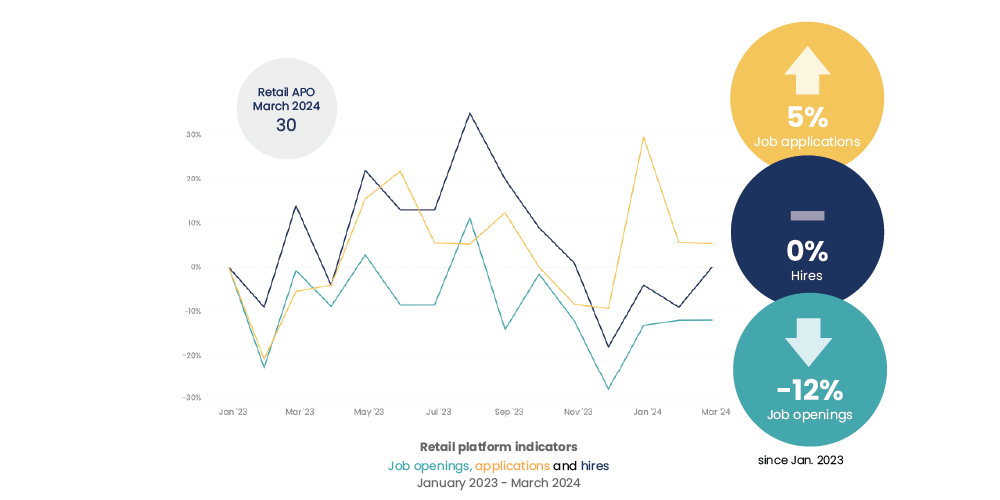

Like many industries, retail endured serious drama in the labor market throughout 2023. The beginning of 2024 offered little respite, as evidenced by a fall in hiring activity in January and February. But hiring inched back to 2023 levels in March, signaling hope and health for the industry.

We dove deep into retail’s job market data in our April Workforce Report. The highlights include:

Download the full April Workforce Report

Rhea Moss is director of customer experience and data insights at iCIMS. She oversees the iCIMS Insights program, which aggregates and anonymizes the billions of data points iCIMS’ software processes per year and transforms them into actionable insights to help drive business and hiring strategies. Previously, Rhea was head of products at prescriptive data, and served as product and program managers at MongoDB and Thomson Reuters.