Accelerate hiring key talent to deliver care and exceed patient satisfaction.

Attract skilled candidates, speed up hiring and grow expertise in your workforce.

Simplify recruiting finance and banking talent with a platform for hard-to-fill roles.

Build a talent pipeline that engages and drives your business forward.

See how diverse and global enterprises use iCIMS to employ millions, drive innovation and connect communities worldwide.

Learn how a beloved restaurant hires 40,000+ annually with a great candidate experience.

Uncover unique market insights, explore best practices and gain access to talent experts across our library of content.

View press releases, media coverage, the latest hiring data and see what analysts are saying about iCIMS.

Streamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and iCIMS.

The combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Our award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Our partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

Employers are at the beginning of the end — of 2024, that is. As employers stare down the typical year’s-end market stagnation, how will their hiring plans hold up? In the November Workforce Report we tackle that very question, examining:

October gave employers many reasons to bring hiring to a standstill. Natural disasters pelted the east coast. Conflict abroad escalated. The presidential race reached its climax.

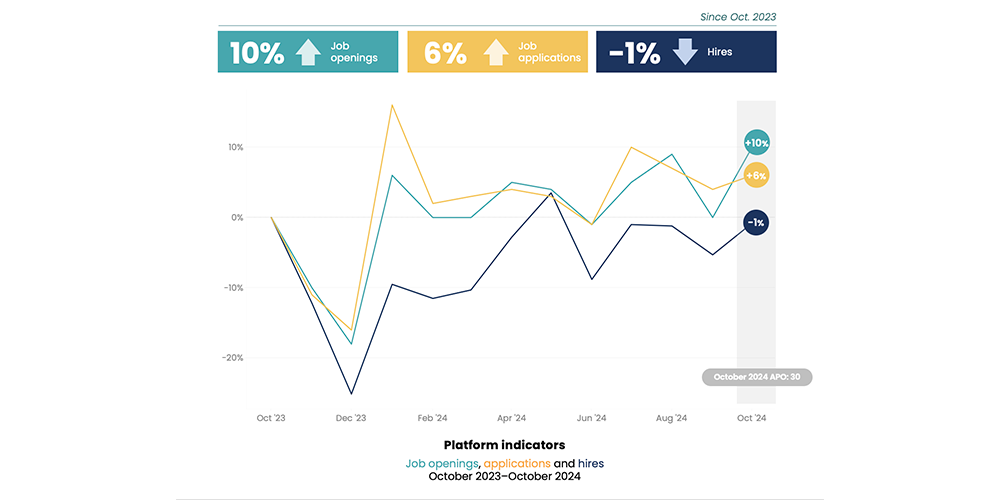

Through it all, how did employers fair? A look at the data reveals that employers persevered through external tumult and increased job openings. In fact, job openings were up 10% in October from the previous month. Hires also ticked up from September.

The question remains: did job seekers follow suit? Not exactly. The data show only a tiny jump in applications — a hairline increase that seems to indicate that most candidates are waiting out the turmoil with their current employers.

As we look to the final months of 2024, we have reason to hope for a strong job market through the end of December. If history tells us anything, however, it’s that hiring activities will cool alongside the weather.

Here, we take the pulse of two industries before we dive down deep into manufacturing.

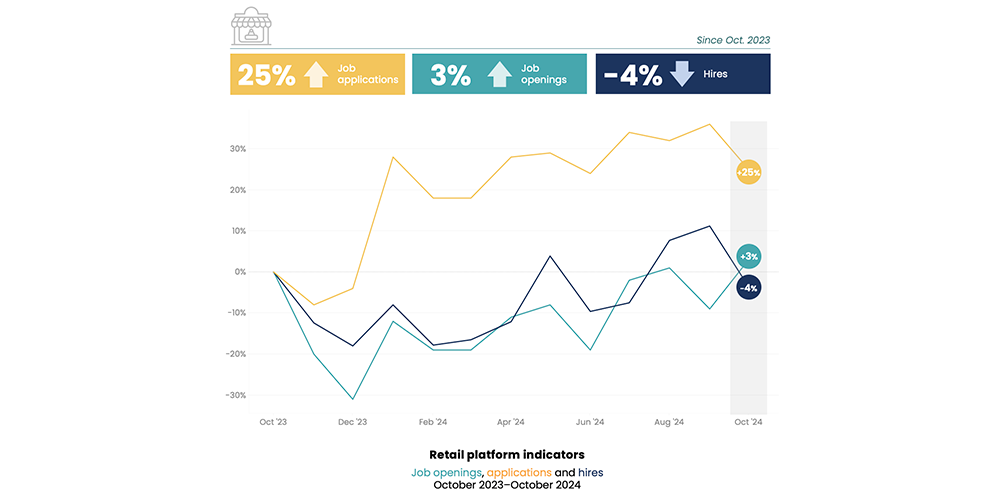

Our October Workforce Report dove into the data on retail ahead of the holiday hiring season, which is now in full swing. We saw that Gen Z comprised the largest pool of retail applicants and learned that more female respondents are interested in seasonal retail jobs than male respondents.

Since then, we’ve been looking at the big-picture data on retail hiring. Here’s what we learned:

The takeaway for employers? If you’re hiring for retail roles, it won’t be hard to drum up interest. But know your audience: you’re pitching jobs to predominantly young, predominantly female job seekers. Factor those demographics into your recruitment marketing strategy accordingly.

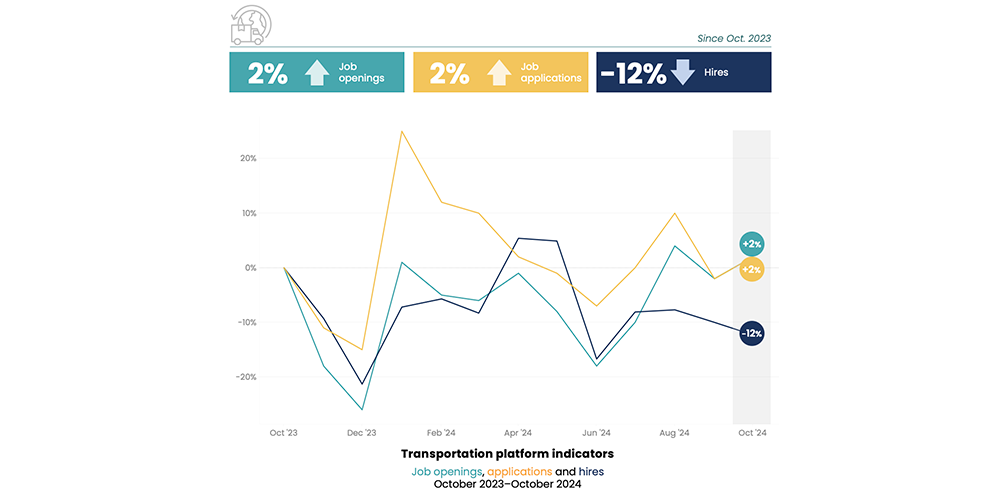

Our October Workforce Report also revealed a surge in job openings for transportation. This news didn’t translate to a slew of transport hires, however. Supply of jobs in transport failed to meet candidate demand in October, as hiring continued to fall — down 2% from September and down 12% from October 2023.

Those awaiting deliveries of holiday gifts and other supplies shouldn’t worry too much, however. Overall employment of delivery truck drivers is projected to grow 9% from 2023 to 2033 — a faster-than-average growth, according to the U.S. Bureau of Labor Statistics.

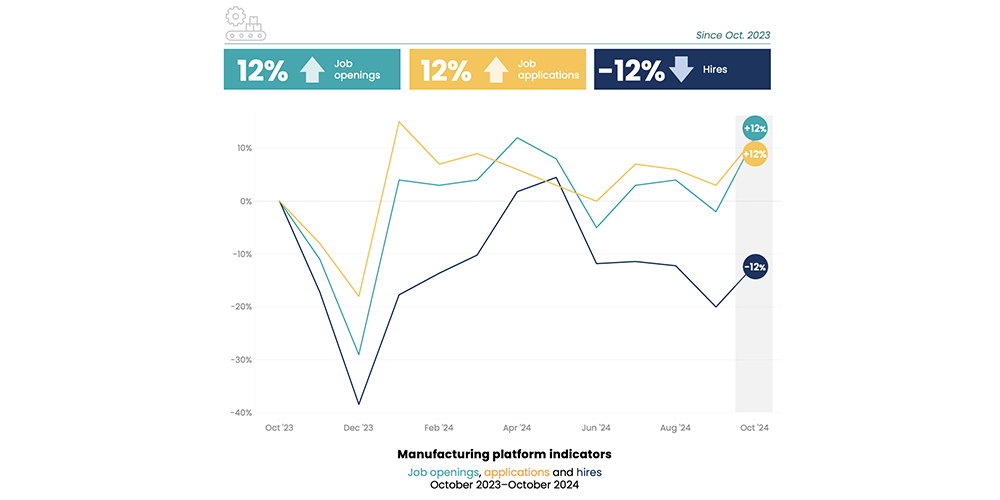

Next we’re going to explore the recent hiring data from the manufacturing industry. As the nation’s fifth-largest employer, manufacturing is an important sector. The industry has faced many challenges post-pandemic, the most recent example of which is the recent machinist strike at Boeing. But the aerospace company is not the only manufacturer with troubles, as the hiring data reveals.

Manufacturers added jobs in only four of the previous 10 months, according to the Labor Department. iCIMS data shows low hiring volume through the second half of 2024. This October’s hiring volume was down 12% from last year’s.

This downward slope raises a serious question for manufacturers: Could the disparity between increased job openings and applications and decreased hires point to a widening skills gap?

To answer this question, it’s helpful to look at the breakdown of applicants. This lens helps us see where job seekers want to take their skills — and which roles are left with few applicants.

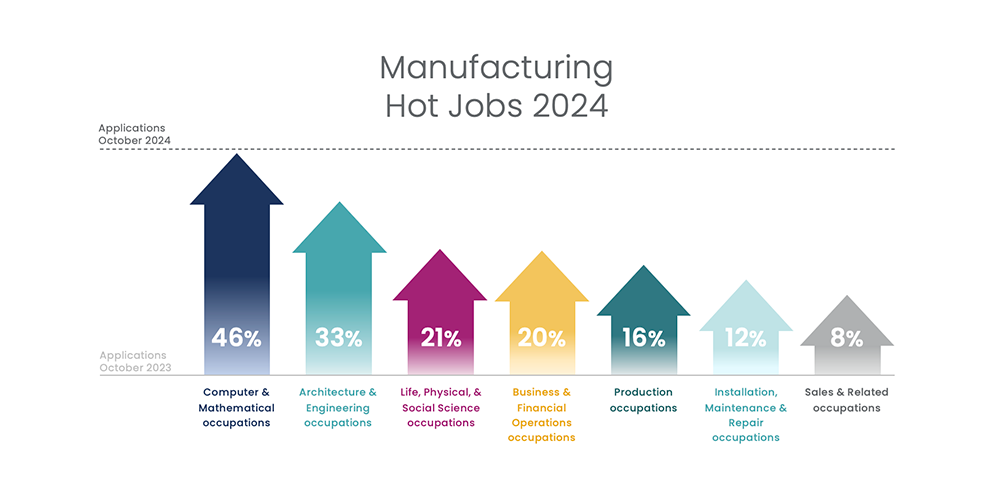

Computer and math jobs are among the most popular gigs in manufacturing. Architecture and engineering are on top, too. Jobs that saw smaller growth skewed toward more traditional manual jobs, including:

To make sense of this data, it’s important to put it in its proper context. While jobs like engineering and other STEM opportunities are popular among applicants, data indicates that the positions may soon outnumber the workers. Estimates show that the U.S. will be short some 300,000 engineers and 90,000 technical workers by 2030, according to the U.S. Commerce Department.

Manufacturers must work proactively to close this gap. New AI-powered tools are helping recruiters pinpoint manufacturing talent offering the skills they need. But employers will also need to build up their pipelines to ensure long-term access to talent.

Many employers are doing this by focusing on new talent pools not traditional to the industry. Women, for instance, fill only 30% of manufacturing jobs, the Census Bureau says. That could be changing, however, according to iCIMS data.

iCIMS found that applications by women to the manufacturing sector grew 60% since January 2022 — putting women only slightly behind their male counterparts, who saw a 65% growth in the same period.

To keep up with hiring trends, manufacturers must get serious about recruiting and retaining women, especially those offering STEM-centered skills. Tactics may include spotlighting current female employees, offering family-friendly benefits, and promoting flexible scheduling.

Download the full November Workforce Report.

Rhea Moss is director of customer experience and data insights at iCIMS. She oversees the iCIMS Insights program, which aggregates and anonymizes the billions of data points iCIMS’ software processes per year and transforms them into actionable insights to help drive business and hiring strategies. Previously, Rhea was head of products at prescriptive data, and served as product and program managers at MongoDB and Thomson Reuters.