Accelerate hiring key talent to deliver care and exceed patient satisfaction.

Attract skilled candidates, speed up hiring and grow expertise in your workforce.

Simplify recruiting finance and banking talent with a platform for hard-to-fill roles.

Build a talent pipeline that engages and drives your business forward.

See how diverse and global enterprises use iCIMS to employ millions, drive innovation and connect communities worldwide.

Learn how a beloved restaurant hires 40,000+ annually with a great candidate experience.

Uncover unique market insights, explore best practices and gain access to talent experts across our library of content.

View press releases, media coverage, the latest hiring data and see what analysts are saying about iCIMS.

Streamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and iCIMS.

The combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Our award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Our partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

Summer is in full swing for those of us in the northern hemisphere. Is the labor market sweltering or out on summer vacation? Our July Workforce Report provides:

Stateside, the labor market shows evidence of a summer slowdown. iCIMS platform data saw declines across the biggest markers in June. Job openings, applicants and hires are all down compared to January 2023. But the more troubling fall occurred month to month: hires, for example, fell 13% in June.

These declines are typical for early summer. But this year’s drop off — in both employer and candidate activity — is particularly dramatic.

The downturn can be attributed to many external factors. The slew of summer holidays always slows down employment activity. And many employers are likely focused on the end of the quarter, putting their hiring activities on pause.

It’s worth noting that an unpredictable economy and a chaotic election may contribute, as well. As these factors come to a head, time will tell whether the hiring market heats back up or continues to cool down.

Now that we’ve covered the U.S. labor market, let’s expand our horizon and consider what’s going on with candidates and employers in the EMEA region.

First and foremost, application volume is down. The good news? The figure is still up nearly 20% since January 2023. Job openings, however, are down 11% from that time. Despite this, they have remained fairly consistent over the past year, discounting the typical drop around the winter holidays.

With applications up and job openings holding steady, companies are beginning to make more hires. Hiring in the EMEA region is up 12% YOY and 4% since January 2023.

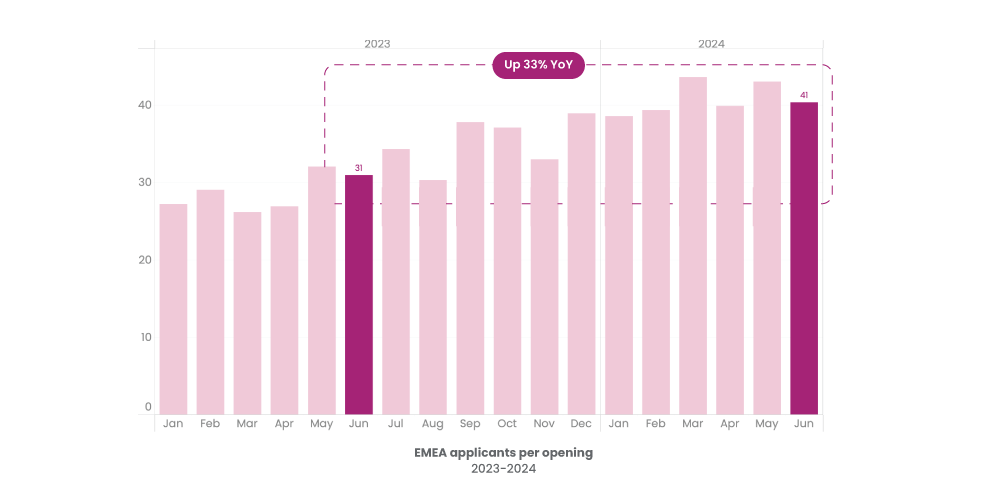

Let’s go behind the scenes on these hiring figures. EMEA applicants are flooding the candidate pipelines, and applicants per opening has swelled by 33% as a result. With so many candidates per role — a whopping 41, on average — EMEA candidates have lost some bargaining power.

Recruiters, meanwhile, have kept pace with the influx of applicants. Surprisingly, time to fill has sped up, despite an increase in applicants and a decrease in recruiters. This change raises a couple of questions. Has the use of artificial intelligence already improved efficiency? Or are recruiters sacrificing the candidate experience to speed through applicants?

For answers to these questions and more, download the July Workforce Report.

To delve even deeper into EMEA applicants, let’s examine their demographics.

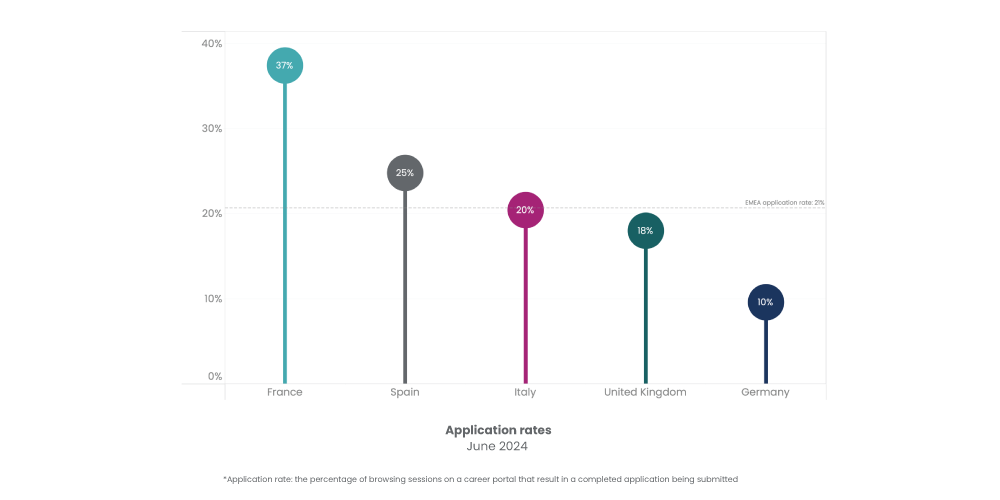

To analyze the applicant rate by location, we broke career site visitors down by country. The application rate measures how often browsing sessions on career sites convert into applications. It’s a metric that reveals where candidates are most engaged.

France was a clear winner. In France, over a third of sessions on career sites gave way to a completed application. The next most-engaged country was Spain, where a quarter of visits prompted applications. Italy, the United Kingdom and Germany followed.

A deep dive into applicants’ ages was also illuminating. Younger generations dominate the applicant pool. iCIMS data revealed that around 70% of people applying for jobs in the EMEA region are younger than 35. In France, the job seekers are particularly young. The 18- to 24-year-old age group comprised nearly 70% of its applicants. And 85% of applicants were under the age of 35.

Knowing the countries and generations applicants belong to can give recruiters incredible insights into their job seekers. By tailoring their employer branding, messaging and processes to applicants’ preferences, recruiters can find and win stronger applicants who will perform more strongly on the job.

Download the full July Workforce Report.

Rhea Moss is director of customer experience and data insights at iCIMS. She oversees the iCIMS Insights program, which aggregates and anonymizes the billions of data points iCIMS’ software processes per year and transforms them into actionable insights to help drive business and hiring strategies. Previously, Rhea was head of products at prescriptive data, and served as product and program managers at MongoDB and Thomson Reuters.