- Solutions

- Products

- Community

- Resources

- Company

Create incredible candidate experiences that communicate your brand, mission, and values with recruitment marketing solutions.

Learn moreCommunicate effectively and efficiently with the candidates that can drive your business forward.

Learn moreSelect the right candidates to drive your business forward and simplify how you build winning, diverse teams.

Learn moreHelp your best internal talent connect to better opportunities and see new potential across your entire organization.

Learn moreCommunicate collectively with large groups of candidates and effectively tackle surges in hiring capacity.

Learn moreAccess tools that help your team create a more inclusive culture and propel your DEI program forward.

Learn moreRebound and respond to the new normal of retail with hiring systems that are agile enough to help you forge ahead.

Learn moreAccelerate the hiring of key talent to deliver point of care and support services that meet and exceed your promise of patient satisfaction.

Learn moreAttract and engage candidates with technical competencies, accelerate hiring for much-needed skills, and advance expertise within your valued workforce.

Learn moreSimplify how you recruit finance, insurance, and banking candidates with a unified platform built to match top talent with hard-to-fill roles.

Learn moreYour business strategy depends on your people strategy. Keep both in lockstep with the iCIMS Talent Cloud.

Learn moreBuild an engaging, high-converting talent pipeline that moves your business forward.

Learn moreDeliver the innovation your talent team needs, along with the global scale and security you demand.

Learn moreDeliver tailored technology experiences that delight users and power your talent transformation with the iCIMS Talent Cloud.

Learn moreThe #1 ATS in market share, our cloud-based recruiting software is built for both commercial and large, global employers.

Learn more Talk to salesAttract the best talent for your business with powerful, on-brand career websites that excite candidates and drive engagement.

Learn more Talk to salesCombine behavior-based marketing automation with AI insights to build talent pipelines, engage candidates with multi-channel marketing campaigns, and automatically surface the right talent for the job.

Learn more Talk to salesEmpower candidates with automated self-service, qualification screening, and interview scheduling through an AI-enabled digital assistant.

Learn more Talk to salesSimplify employee onboarding with automated processes that maximize engagement and accelerate productivity.

Learn more Talk to salesVerify skills with game-changing levels of automation and simplicity to improve the quality of hire at scale.

Learn more Talk to salesModernize, streamline, and accelerate your communication with candidates and employees.

Learn more Talk to salesTransform the talent experience by showcasing your authentic employer brand through employee-generated video testimonials.

Learn more Talk to salesSimplify recruiting, dynamically engage talent, and reduce hiring bias with job matching and recruiting chatbot technology.

Learn moreStreamline and centralize your HR tech stack with configurable, flexible, secure and reliable integrations.

Learn moreHow a beloved restaurant hires 40,000+ annually with a great candidate experience.

Learn moreThousands strong, our global community of talent professionals includes creatives, innovators, visionaries, and experts.

Learn moreTogether we’re creating the world’s largest ecosystem of integrated recruiting technologies.

Learn morePartner with our global professional services team to develop a winning strategy, build your team and manage change.

Learn moreExplore our network of more than 300 certified, trusted third-party service and advisory partners.

Learn moreUncover unique market insights, explore best practices and gain access to talent experts across out library of content.

Get resourcesExpert guidance about recruitment solutions, changes in the industry, and the future of talent.

Learn moreStay up to date with the latest terminology and verbiage in the HR software ecosystem.

Learn moreEmployers everywhere improve hiring efficiently and save money using iCIMS. Estimate the potential business value you can achieve.

Learn moreDive into the Class of 2023 Report highlighting this cohort’s expectations and where employers are willing — and able — to meet them.

Watch nowPartner with iCIMS to build the right strategies, processes, and experience to build a winning workforce.

Learn moreExpert guidance about recruitment solutions, changes in the industry, and the future of talent.

Learn moreDeliver the innovation your talent team needs, along with the global scale and security you demand.

Learn moreView press releases, media coverage, and the latest hiring data. See what analysts are saying about iCIMS.

Learn moreiCIMS is the Talent Cloud company that empowers organizations to attract, engage, hire, and advance the talent that builds a winning workforce.

Learn moreGet to know the award-winning leadership team shaping the future of the recruiting software industry.

Learn moreWe believe the future of work isn't something that "happens" to you. It's something you create. We actively create the future of work with our customers every day.

Learn moreiCIMS is committed to being a responsible and ethical corporate citizen, which is why Environmental, Social and Governance (ESG) initiatives are strategic imperatives.

Learn moreStreamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and the iCIMS Talent Cloud.

Learn moreThe combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Learn moreOur award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Learn moreOur partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

Learn moreLet’s get in touch. Reach out to learn more about iCIMS products and services.

Learn more

Nearly two-thirds of healthcare executives in a recent survey by Optum named finding skilled talent as one of their top priorities for 2023. But to understand the talent challenges the healthcare industry faces today, we have to go back in time, according to Rhea Moss, global head of workforce and customer insights at iCIMS.

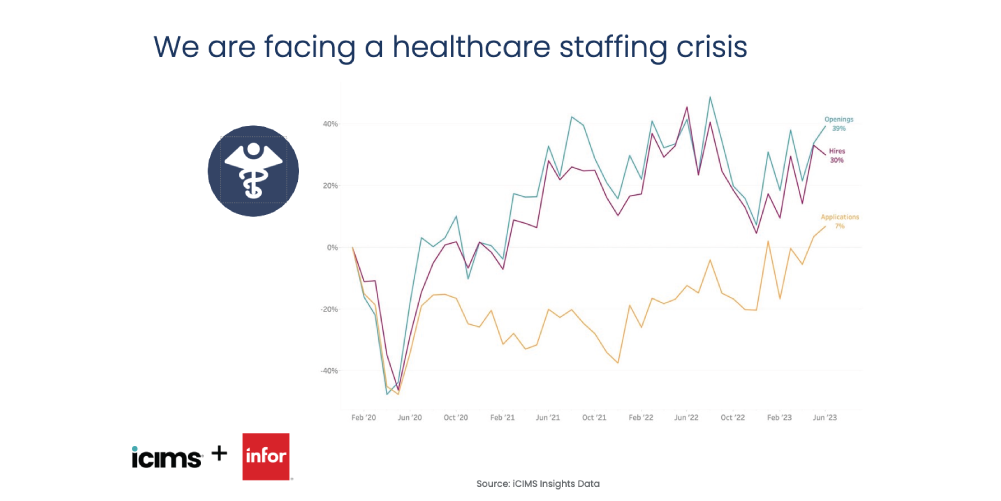

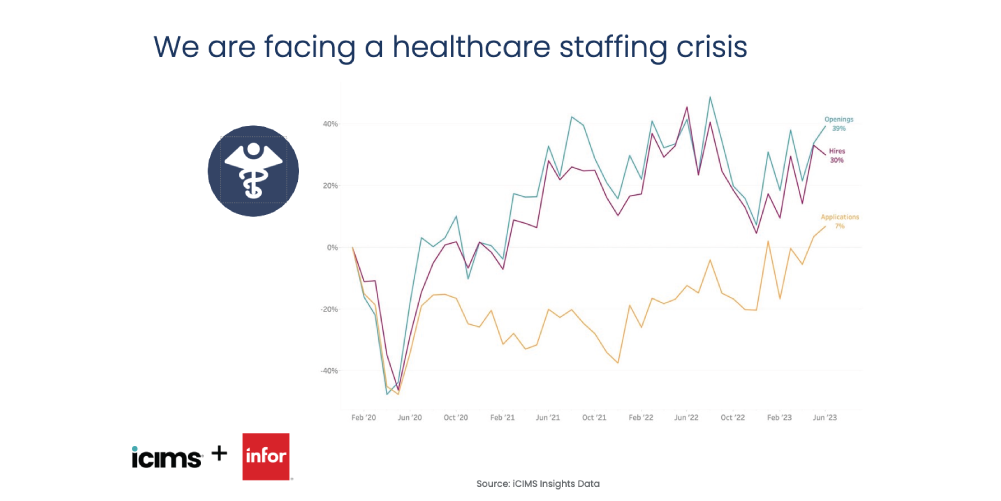

In a recent iCIMS webinar, Moss and two other experts explored the three key indicators that reveal the state of the healthcare talent market now and how it’s changed in the last three years. According to iCIMS Insights Data, job openings are up 39% and hires have climbed 30% since 2020. These figures don’t deviate much from what’s going on in the overall market, where there are 33% more job openings and 35% more hires.

Applications follow this trend in the broader talent market — there are 37% more applicants than there were in 2020. But in healthcare, applicants have grown by only 7%.

“Healthcare is seeing nearly 40% more jobs, but they’re trying to fill them with only 7% more applicants,” Moss said. “Generally, the market is starting to become an employer’s market. But not in healthcare. There has not been the same recovery in healthcare as elsewhere.”

A shortage of applicants leaves healthcare employers struggling to fill jobs. While this figure shows where healthcare deviates from other industries, it’s far from the sector’s only problem. Below, delve into the iCIMS data that shows why hospitals, urgent care centers and other providers are battling high turnover, external competition and burnout — all of which create the talent crisis.

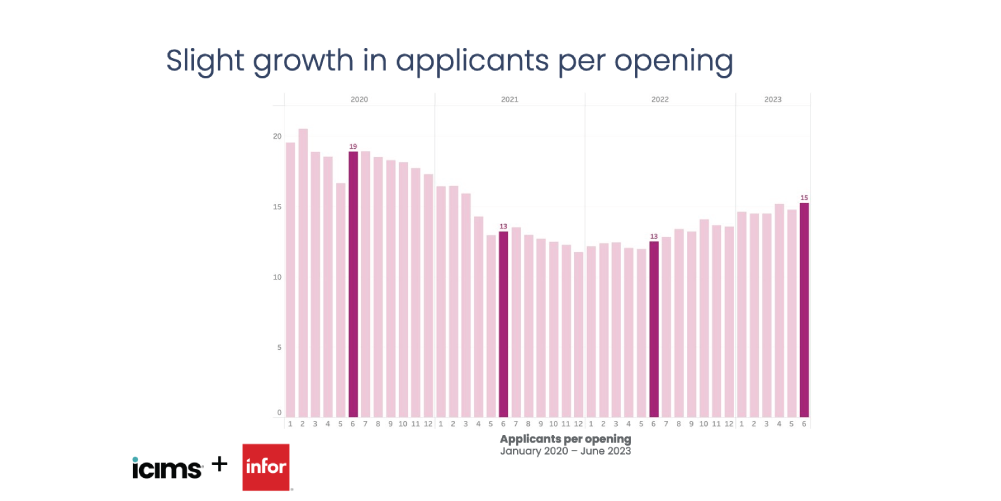

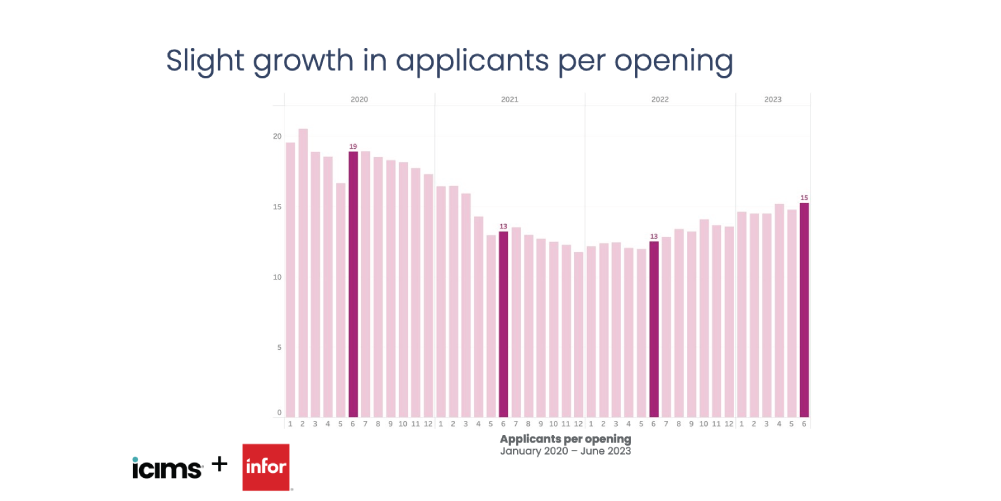

Applications have yet to bounce back from their pandemic-lows, and employers are likewise waiting on applicants per opening to recover. Employers in healthcare see about 15 applicants per opening.

The good news? That number is higher than it’s been in the last two years. But it’s remarkably lower than it was before the pandemic, Moss said. And it’s 60% lower than the applicants per opening rate in the overall market.

“There is hopefully a sigh of relief,” Moss said. “It’s heading where we’d like it to head, even if we’d like it to head there faster.”

Faced with smaller pools of applicants, employers may struggle to find talent with the right qualifications, certifications and experience, said Marcus Mossberger, future of work strategist at Infor. Moss agreed. The question of applicant quality points to the double nature of the talent crisis in healthcare, she said. Healthcare employers not only lack potential talent — they’re also losing the talent they already have.

“We have to think of this as fixing a leaking bucket,” Moss said. “We’re losing talent so fast and we know we can’t fill their roles at the rate we need to fill them.”

Employee exits decreased at the end of 2022, according to the 2023 NSI National Health Care Retention & RN Staffing Report. But other factors like labor shortages, employee burnout and retirements have kept hospital turnover rates up overall. The fact remains that in the last five years, the average hospital has turned over 105% of its staff. And 95% of all hospital separations are voluntary terminations.

That’s why, “in this space, you never stop recruiting,” Moss said.

As Infor’s Mossberger put it, recruiting and retention are two sides of the same coin in talent acquisition.

For many employers, this integrated strategy manifests as internal mobility, said Brianna Zink, MSN, senior director of product strategy at Infor. Employers must be open and communicative about opportunities to allow employees to move to new roles within the organization. This way, employers can offer opportunities that alleviate pain points without losing workers to other industries.

Though this strategy is needed to slow quit rates, few employers tap into its potential. “There is skyrocketing growth in the percent change in applicants to external opportunities. But that’s not happening with internal jobs,” Moss said. “Internal job growth is not where we want it to be.”

Read: How an internal mobility program can help retain healthcare employees

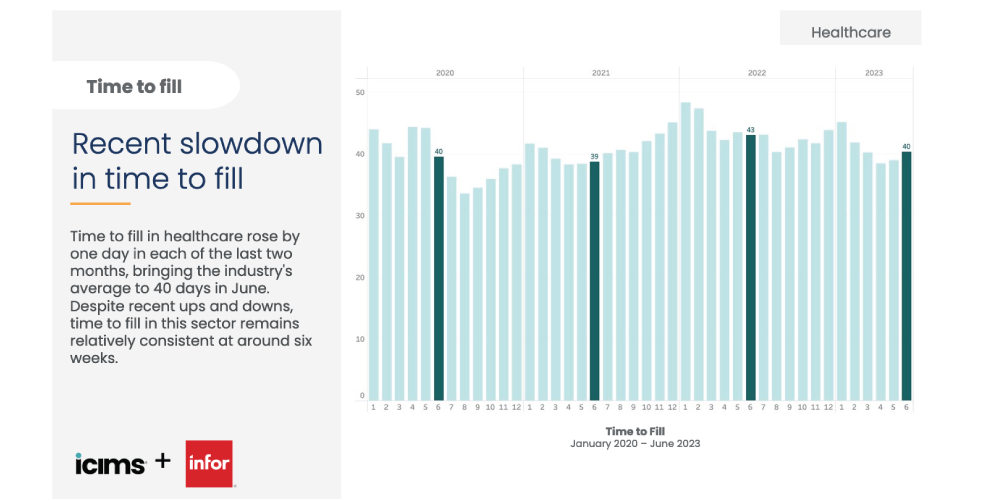

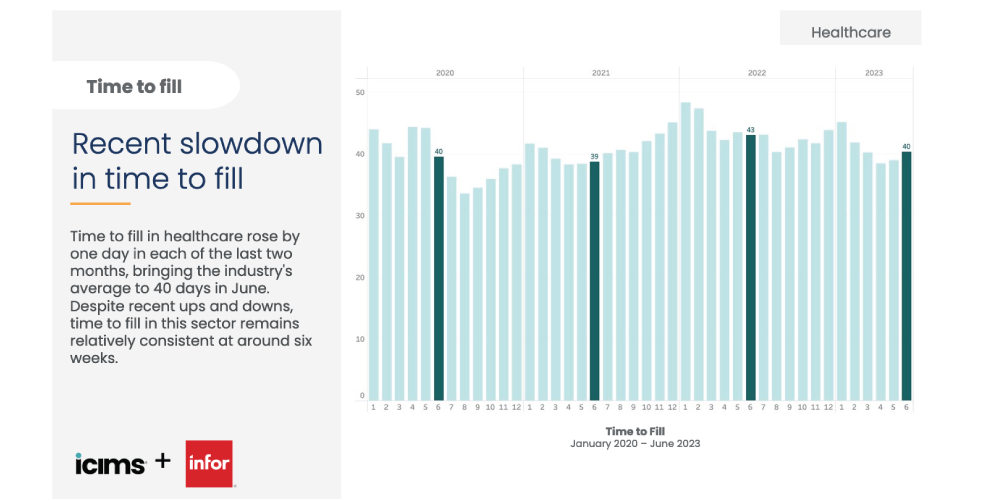

Employers may celebrate the growth of applicants per role, but they’re likely dismayed at the overall uptick in time to fill. While the industry has seen time to fill rates speed up and slow down intermittently throughout the last year, it’s important to note that, overall, the rates are much slower than in other industries.

“If someone is applying for a job in healthcare and a job in retail, we’re competing against those retailers,” Moss said. “They may not be our competition from a business perspective, but they absolutely are from a talent perspective.”

Of course, hospitals and urgent care centers face far more hiring restrictions than shoe stores and home decor shops. A cashier needs far less experience to ring up a pair of sneakers than a nurse needs to discharge a patient. But hiring restrictions won’t stop job seekers from getting impatient with a slow candidate experience.

If healthcare employers can’t compete with a restaurant’s fast hiring rates, they need to make up for it with communication, Moss said. Employers need to explain to candidates that the hiring process takes time because they have to ensure patient safety above all.

This challenge may prompt employers to get creative about how they assign tasks. “Are there tasks that could be done by talent that don’t want to work in a hospital? Or who are a little less experienced?” Moss asked. “That’s an interesting mindset.”

Zink agreed that it’s important for employers to look granularly at the work that needs to be done and the workers available to do it. When employers assign more basic tasks to employees who are less experienced and less qualified, they free up those who are at the top of their licensure — roles that are harder to fill.

Read: Why the best hospitals use automated reference checks

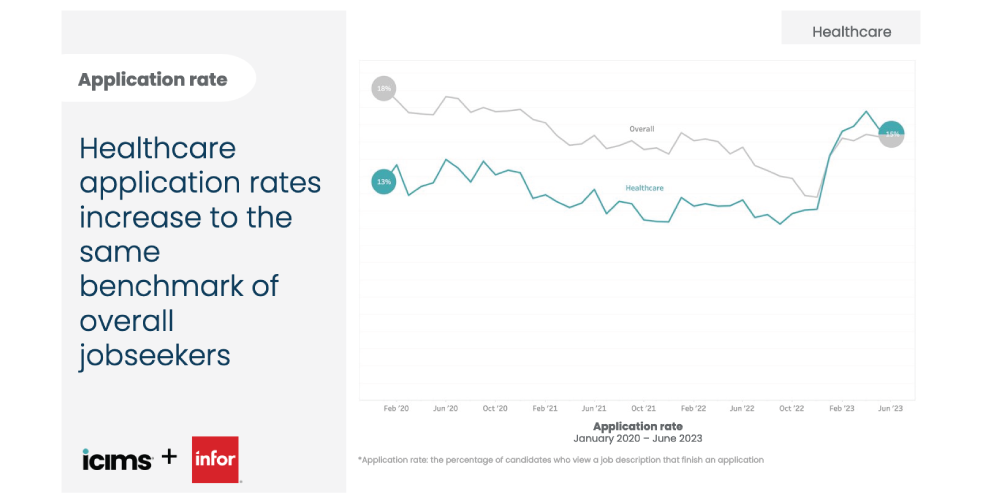

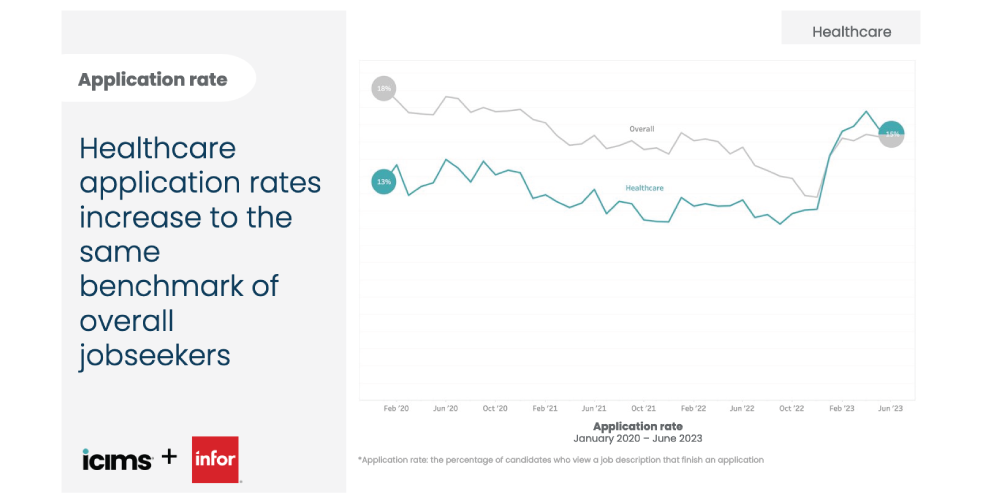

There is some good news for healthcare employers: Healthcare is seeing a similar application rate as the overall market. Applicants are showing more interest in healthcare, Moss explained. They’re filling out applications at higher rates than we’ve seen historically.

But something threatens this positive change: Burnout among workers who are already there. Healthcare workers are willing to leave their industry, Moss said. According to a 2021 study published by the National Library of Medicine, about two‐thirds of the nurses report high levels of job burnout.

These high levels of stress and frustration couple with another factor toprime healthcare talent to exit their field. According to a recent study from connectRN, a staffing platform for nurses, 50% of nurses earn extra income through side hustles. These side jobs show nurses and other healthcare professionals the ease of other industries, Moss said. When nurses have bad days at the hospital, they start to wonder whether they should make their side hustle their central source of income.

In many instances, these side hustles deliver two things healthcare talent want: Lower-stress environments and flexible scheduling. This should prompt hospitals to think creatively about how they can meet these needs, Zink said. Could hospitals introduce collaborative scheduling or self-assigning for shifts?

These questions point employers to internal mobility again, Zink pointed out. A good employee may be smart and certified and qualified but dislikes their current job. “There’s no sense losing them because they don’t know about other opportunities,” Zink said.

Read: Pressing the reset button on healthcare hiring in a tight labor market

We’ve explored some of the biggest talent challenges facing healthcare right now. But there’s still more at play. For an even deeper dive into the numbers, check out the full on-demand webinar here.

Alex is well-versed in content and digital marketing. He blends a passion for sharp, persuasive copy with creating intuitive user experiences on the web. A natural storyteller, Alex highlights customer successes and amplifies their best practices.

Alex earned his bachelor’s degree at Fairleigh Dickinson University before pursuing his master’s at Montclair State University. When not at work, Alex enjoys hiking, studying history and homebrewing beer.