Accelerate hiring key talent to deliver care and exceed patient satisfaction.

Attract skilled candidates, speed up hiring and grow expertise in your workforce.

Simplify recruiting finance and banking talent with a platform for hard-to-fill roles.

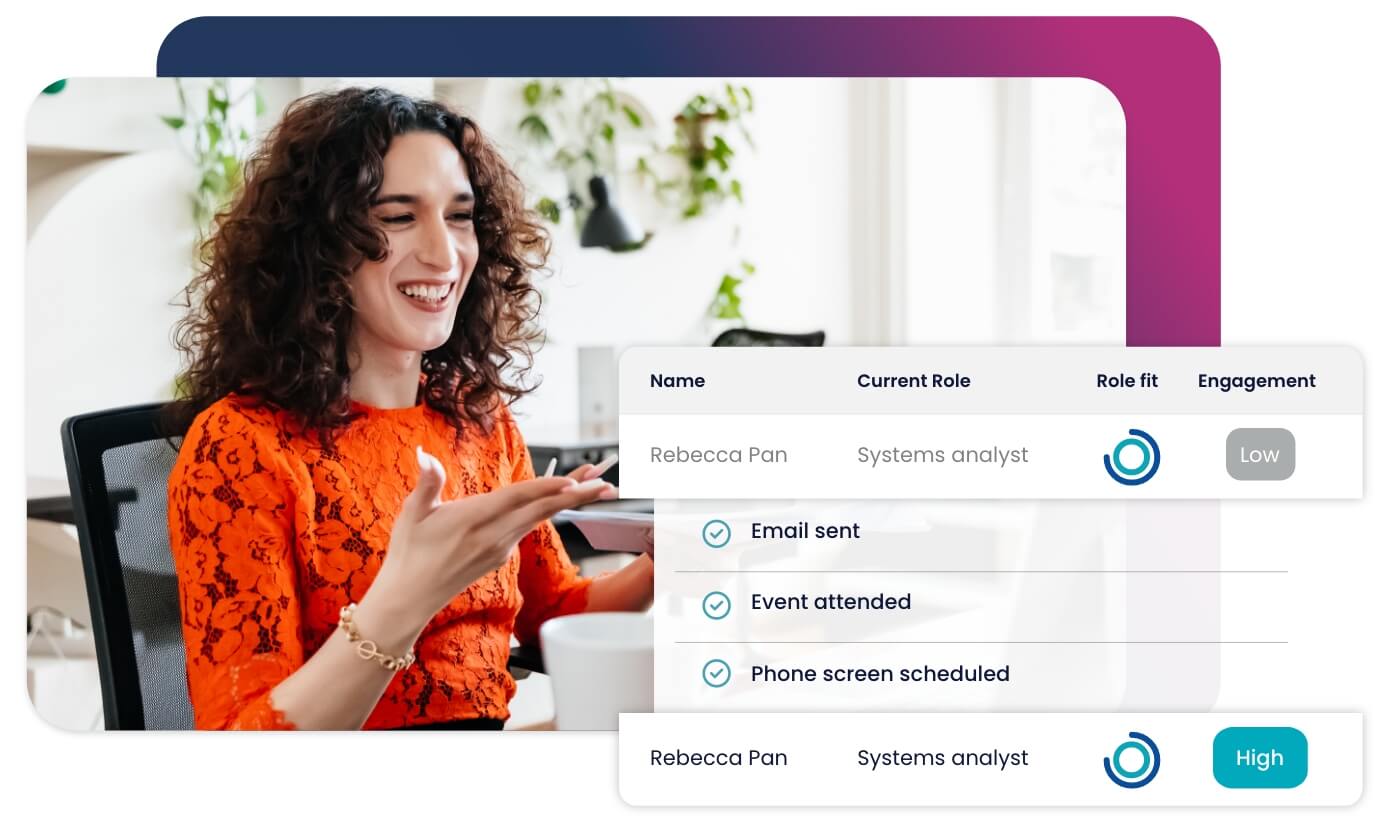

Build a talent pipeline that engages and drives your business forward.

See how diverse and global enterprises use iCIMS to employ millions, drive innovation and connect communities worldwide.

Learn how a beloved restaurant hires 40,000+ annually with a great candidate experience.

Uncover unique market insights, explore best practices and gain access to talent experts across our library of content.

View press releases, media coverage, the latest hiring data and see what analysts are saying about iCIMS.

Streamline your tech stack and take advantage of a better user experience and stronger data governance with ADP and iCIMS.

The combined power of iCIMS and Infor helps organizations strategically align their business and talent objectives.

Our award-winning partnership with Microsoft is grounded in a shared desire to transform the workplace and the hiring team experience.

Our partnership with Ultimate Kronos Group (UKG) supports the entire talent lifecycle by bringing frictionless recruiting solutions to UKG Pro Onboarding.

Financial markets declared the June jobs report to be a “Goldilocks” one and promptly returned to their summer slumber, troubled only by fears of escalating trade conflict. That label is only a minor exaggeration. From a trader’s perspective, this jobs report didn’t leave much to be desired, although it wasn’t quite as strong as most people declared.

Sure, the headlines were all encouraging, with payroll growth strong and unemployment rising due to higher labor force participation. Yet a large portion of the increase in participation came from an upward revision in the long-term unemployed – people who have been off the sidelines and searching for a while. That said, with involuntary part-time work declining by a substantial 205k and wage growth interminably sclerotic, the basic portrait of a labor market with lingering slack and responding well to fiscal stimulus seems intact. As a possibly last clean read on domestic strength before trade tensions take a toll on sentiment, it was a fitting snapshot of the U.S. job market.

The Highlights:

The Rundown:

The Outlook: